AI purposes are evolving quickly. For firms to earn money off of the new expertise, they want customers to settle for utilizing AI as a part of their day by day lives. Meta Platforms (META) took an enormous step towards making AI consumer pleasant this week, making the AI interplay seem to be a chat with a preferred superstar, or simply one other member of your pal group.

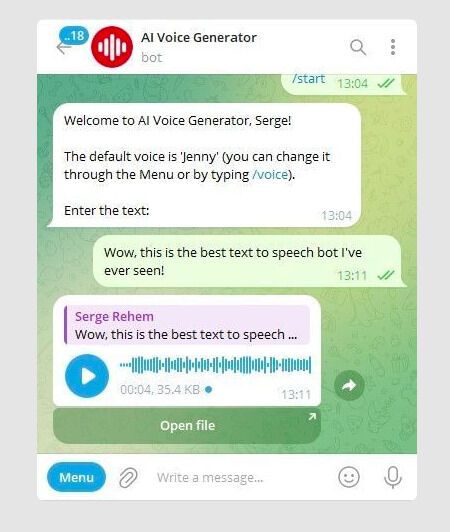

Don’t get me incorrect, ChatGPT and Claude are nice purposes, however most individuals aren’t prepared to turn into “Prompt Engineers” simply to discover out the place the greatest pizza is close to them. To seize the massive shopper market, firms like Meta have to dumb down (sure, ironic when talking of AI) the interface so it’s quite simple to use.

(*3*) AI bots based mostly on fashionable media and historic characters to present each search outcomes, and an AI “buddy” to chat with on Instagram, or by way of WhatsApp, is an enormous step in the proper path. As Ahmad Al-Dahle, METAs VP of Generative AI put it, “You don’t have to pull your self out of context to work together or interact or get the assistant to make it easier to.” It’s what the social media and advertising geeks like to name being “native” to the platform.

Meta and Zuckerberg have been chastised in the enterprise press as being behind in the AI recreation. But with this newest announcement it seems they have been simply taking a while to get it proper…ensuring they weren’t simply blathering about AI for the sake of getting optimistic press.

Meta at the moment has working margins of virtually 29%, and trades at 2.79 occasions gross sales. In the newest quarter, income elevated 11% YoY, and free money movement was a tick underneath $11 billion.

The firm is rated a B general in our POWR Ratings, the place it’s ranked greater than 81% of the shares in our database. Not surprisingly it charges an A for Quality.

As the AI race developed this yr, a number of traders have been asking why solely the massive firms have been “successful” whereas there appeared to be a dearth of small AI firms. Here’s why. Companies like Alphabet (GOOGL)…which I nonetheless name Google…have what it takes to convey worthwhile AI merchandise to market. Cash…AI is EXPENSIVE. Large information units…coaching AI takes a LOT of knowledge. And, at all times useful, a built-in consumer base.

Google, whereas weaving AI into its merchandise, from Gmail to Google Docs, can be focusing closely on permitting builders to make new AI merchandise (which inevitably will work together with Google merchandise) by placing a big effort into AI growth instruments, like its LaMDA, or Language Model for Dialogue Applications.

Thus, a big a part of the Alphabet AI technique is to present the picks and shovels that construct AI. Which, once more, it is rather good at as a result of it possesses huge databases and the wherewithal to prepare AI on these databases.

Oh, and as to the consumer base…as Sundar Pichai, CEO, put it of their most up-to-date earnings launch, “With fifteen merchandise that every serve half a billion individuals, and 6 that serve over two billion every, now we have so many alternatives to ship on our mission.”

GOOGL has an general B score in our POWR Ratings database, performing the greatest in the parts of Quality and Sentiment. The firm has a PE ratio slightly below 28 and has working margins clocking in at a tad underneath 26% as of the newest quarter.

Finally, a inventory that you could be not consider in the similar breath as a Meta or Alphabet, but it surely’s pursuing comparable methods with the huge database it possesses, Yelp (YELP).

As Craig Saldanha, Yelps Chief Product Officer not too long ago wrote, “With the huge quantity of wealthy user-generated content material obtainable on Yelp, we’ve lengthy used AI to energy options throughout our platform, together with dish suggestions, group of images and automating content material moderation, amongst others.”

The inventory, together with the a lot bigger Meta and Alphabet, has achieved fairly properly in 2023, as many smaller firms have missed out on the massive cap growth. Yelp has gross margins of over 85%, and trades at 1.68 occasions gross sales. It has a 97% general score in our POWR scores and is the primary inventory in the Internet class.

Whether making the interface simpler and platform native, META, constructing out instruments for AI builders, GOOGL, or making their product and interface higher for his or her clients, YELP, these three shares are on their respective AI video games. They’re bringing AI to the plenty and may proceed to be rewarded for his or her work on this space.

What To Do Next?

Get your fingers on this particular report with 3 low priced firms with great upside potential even in in the present day’s unstable markets:

3 Stocks to DOUBLE This Year >

META shares have been buying and selling at $305.38 per share on Thursday afternoon, up $7.64 (+2.57%). Year-to-date, META has gained 153.76%, versus a 13.45% rise in the benchmark S&P 500 index throughout the similar interval.

About the Author: Steven AdamsAfter incomes a legislation diploma cum laude with a deal with securities legislation, Steven labored as a Nasdaq market maker for a big dealer supplier, after which as a dealer for an arbitrage centered proprietary hedge fund. He subsequently labored as a guide for a Fortune 500 consulting agency serving each authorities and industrial purchasers, together with the NYSE, Prudential, FDIC, and NASA. More…More Resources for the Stocks on this Article

https://stocknews.com/news/meta-googl-yelp-3-stocks-bringing-ai-to-the-masses/