Fraudsters aren’t contained to a 9-to-5 workday, they usually’re not off on holidays and weekends. Instead, they’re working all hours of the day and evening.

“So from that perspective, it’s worthwhile to have an answer that, if there’s something that goes bump in the course of the evening, it may well choose up on it, and it may well make changes,” John Winstel, senior director of Fraud Product at FIS, instructed PYMNTS.

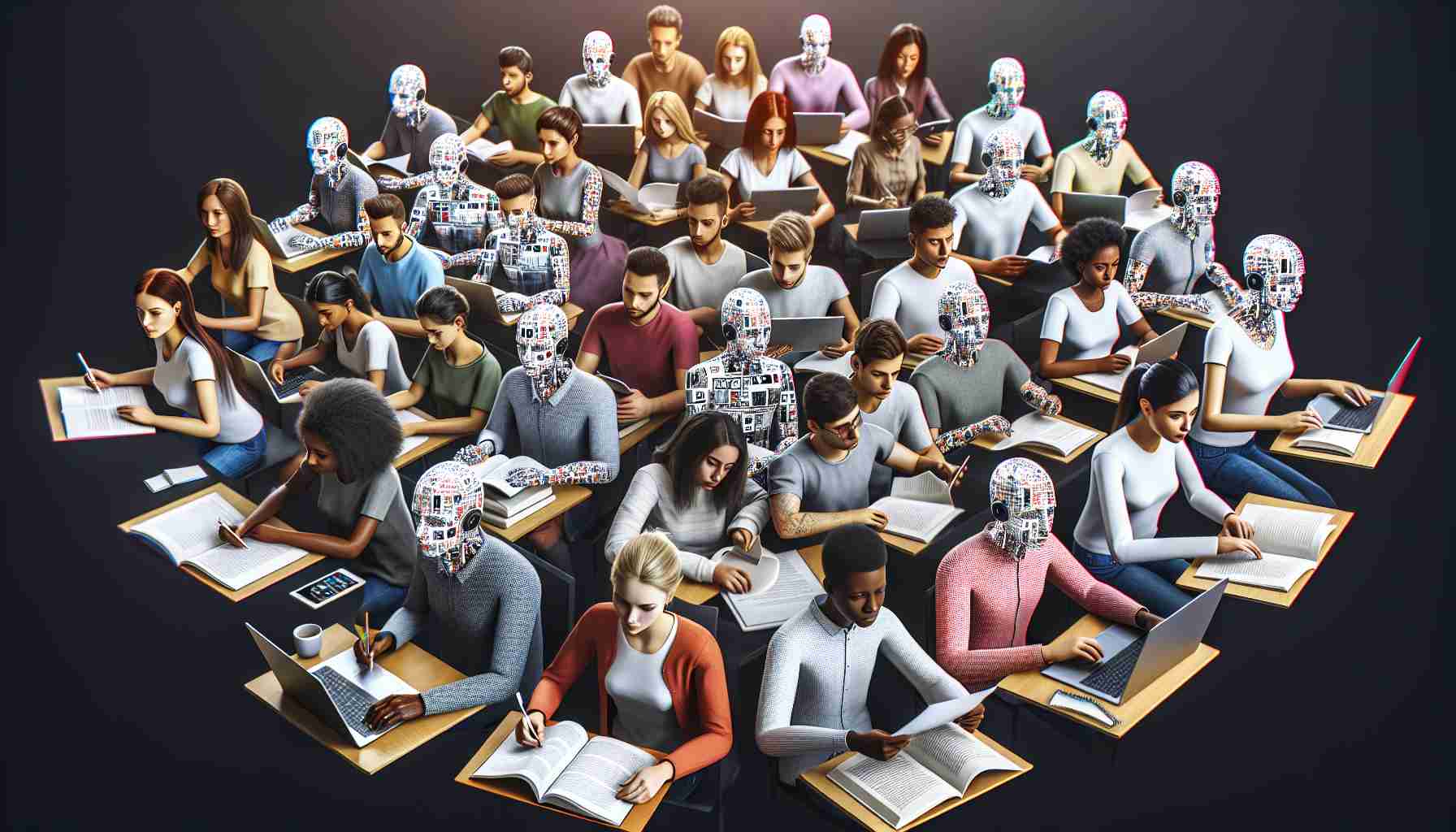

Artificial intelligence (AI) instruments spot these issues that go bump within the evening — or extra particularly, funds dangers — by selecting up on anomalies. To do this, the AI instruments must be fed with knowledge.

The AI instruments can then choose up on anomalies, make sense of the info, after which go in and alter the fraud administration methods. By doing so, they save people the necessity to do the tedious strategy of going by reported fraud and suspicious exercise, permitting the people to deal with different parts of fraud administration as an alternative.

“What we have now discovered, is once you take an assisted AI method, the place you mix the facility of AI together with the information of one in all our fraud analysts collectively, that’s the place you begin seeing the most effective authorization charges, the tip person expertise begins to get higher, and we begin seeing the place you’re actually optimizing your total providing whereas on the similar time mitigating these fraud losses,” Winstel mentioned.

Spotting Anomalies, Setting off Alarm Bells

Card testing is a fraud development that’s scorching proper now, with fraudsters getting a maintain of card knowledge and attempting to determine what’s legitimate. That’s an space the place AI and machine studying (ML) can intervene. Since it is aware of what the service provider’s regular authorization charge is, the AI instrument can set off alarm bells when it all of the sudden sees 1 million transactions per day the place it usually sees only one,000.

“You shouldn’t need to have an individual that’s going and intervening,” Winstel mentioned. “That’s the place AI may even assist to determine these sort of anomalies and assist to close it down.”

Another development over the past a number of years has been in regards to the objectives of those that use fraud-management instruments. They was once most involved about holding fraud losses low, however fraud mitigation that’s too stringent and declines too many good transactions could cause retailers to lose not solely that sale, but additionally the shopper.

“It’s going to value you much more in the long term,” Winstel mentioned. “The value of a false decline may be large for everyone within the ecosystem.”

Sharing Data to Maximize Authorization Rates

One answer is to carry collectively retailers and issuers as we take a look at methods to enhance approval charges whereas mitigating fee danger. For instance, retailers can share that they know a transaction is nice and must be permitted as a result of they know the shopper is an effective buyer.

“The market’s going to proceed to go there — we’re not the one ones which can be doing that, I understand that,” Winstel mentioned. “There’s going to be increasingly more, from an information sharing perspective, to offer these indicators from either side of the transaction in order that we are able to actually begin to maximize our total authorization charges.”

Looking forward, Winstel mentioned that as increasingly more shoppers store each in-store and on-line, retailers might want to ensure that all their fraud prevention instruments discuss to one another.

For instance, if the service provider has a superb buyer who makes purchases regularly within the retailer, that data must be shared with the service provider’s eCommerce fraud answer, so the shopper has a superb expertise when shopping for on-line and selecting up curbside.

“I feel over the course of the subsequent 12 months or so, the subsequent few years, it’s going to be all about cross-channel fraud administration and bringing all that knowledge collectively,” Winstel mentioned.

——————————

NEW PYMNTS DATA: 70% OF BNPL USERS WOULD USE BANK INSTALLMENT OPTIONS, IF AVAILABLE

About: Seventy p.c of BNPL customers say they’d reasonably use installment plans supplied by their banks — if solely they had been made accessible. PYMNTS’ Banking On Buy Now, Pay Later: Installment Payments And FIs’ Untapped Opportunity, surveyed greater than 2,200 U.S. shoppers to higher perceive how shoppers view banks as BNPL suppliers in a sea of BNPL pure-plays.

https://www.pymnts.com/news/risk-management/2022/a-connected-economy-requires-connected-risk-management/